vermont sales tax on alcohol

See our website at taxvermontgov for information related to the necessary forms and for due dates. Preliminary reports are created 75 days after the end of.

Vermont Department Of Liquor And Lottery 2021 Annual Report By Yankee Publishing New Hampshire Group Issuu

Exemptions to the Vermont sales tax will vary by state.

. Contain one-half of 1 or. A transaction is subject to local option tax if it is subject to the Vermont. Sales and Use Tax.

Sales for each town. O Includes sales from State liquor agents to bars and restaurants. Alcoholic Beverage Sales Tax.

The Barre Vermont sales tax is 600 the same as the Vermont state sales tax. 10 alcohol tax 1 11 total tax. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

Vermont state and local compliance rules for businesses shipping wine direct to consumers DTC in the state. Are suitable for human consumption and. For those who supply spirits to the Vermont Division of Liquor Control.

Constitution repealed the Volstead Act Prohibition. 15th highest liquor tax. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. PA-1 Special Power of Attorney. For those who sell beer cider RTD spirits beverages or wine to stores or restaurants.

The Burlington Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Burlington local sales taxesThe local sales tax consists of a 100 city sales tax. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Sales Tax on Shipping.

Alcoholic beverages subject to meals and rooms tax are exempt from sales and use tax. The Department of Taxes publishes Meals and Rooms Tax and Sales and Use Tax data by month quarter calendar year and fiscal year. Sales up to 500000.

11 Vermont Alcoholic Beverage Tax Schedule 10 State Tax 1 Local Option Tax For use where Local Option Alcoholic Beverage Taxapplies EFECTIVE JULY 1 2003. IN-111 Vermont Income Tax Return. Such as gasoline or alcohol usually imposed on the producer or.

Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. Control of the sale. Beer over 6 percent alcohol by volume.

While many other states allow counties and other localities to collect a local option sales tax Vermont. The sales tax rate is 6. Alcohol tax Malt and Vinous Beverage Tax.

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. Summary of Vermont Alcoholic Beverage Taxes Beer and Wine Gallonage Tax 7 VSA. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US.

Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Local Option Alcoholic Beverages Tax.

Sales of alcoholic beverages by retailers such as grocery stores or convenience stores that. Additionally wholesalers must pay a tax on spirits and fortified wines as follows. For beverages sold by.

W-4VT Employees Withholding Allowance Certificate. 974113 with the exception of soft drinks. Vermont Use Tax is imposed on the buyer at.

Sales Taxes In The United States Wikipedia

Are Vermonters Paying The State S Mandatory Use Tax Spoiler Nope Economy Seven Days Vermont S Independent Voice

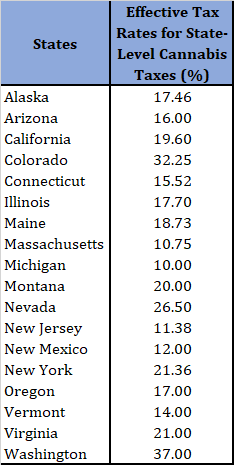

Assessing State Level Adult Use Cannabis Taxation Aaf

These States Have The Highest And Lowest Alcohol Taxes

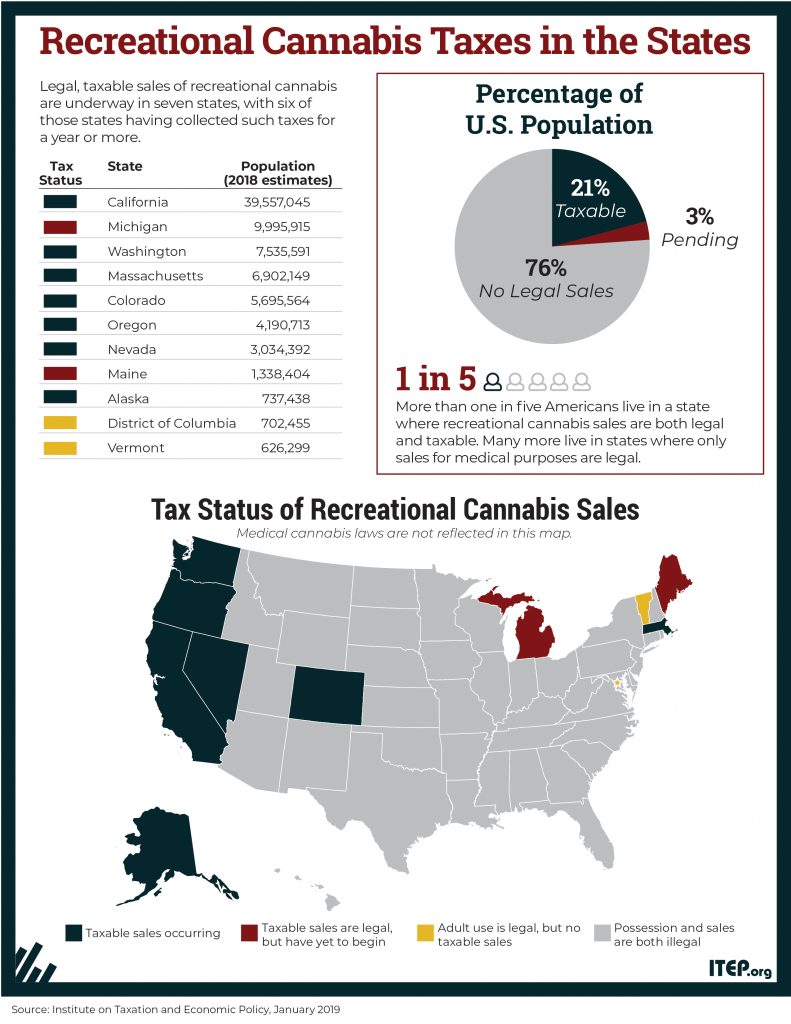

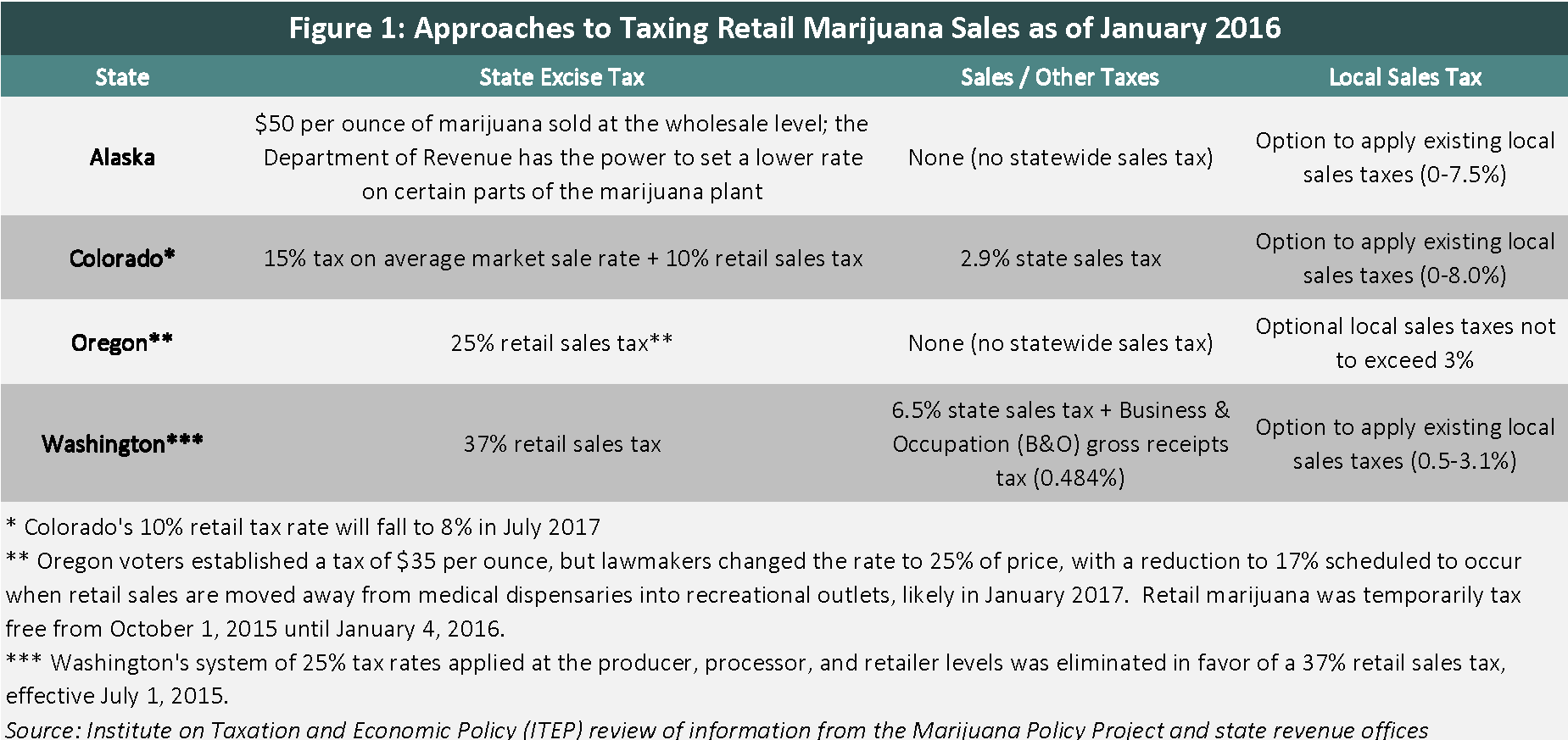

Testimony Before The Vermont Senate Committee On Finance Tax Policy Issues With Legalized Retail Marijuana Itep

How High Are Spirits Taxes In Your State Tax Foundation

Vermont Lowers Ready To Drink Spirits Taxes The Hill

How High Are Wine Taxes In Your State State Excise Tax Rates On Wine

Alcohol Taxes On Beer Wine Spirits Federal State

Governments Dip Deeper Into Alcohol Tax Well

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

State Budgets Are So Flush Even Vermont California Progressives Are Cutting Taxes

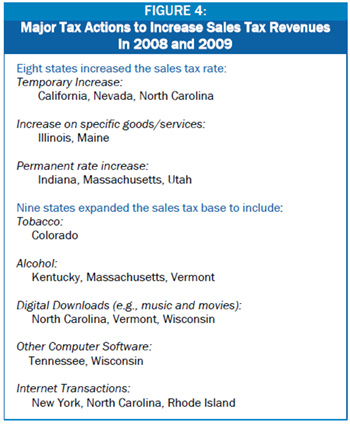

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

Liquor Taxes How High Are Distilled Spirits Taxes In Your State

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)